Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Data centre electricity demand is soaring globally, driven by digitalisation and AI. In Europe, this growth is rapidly outpacing grid capacity, making strategic location and proactive infrastructure policy more critical than ever.

Portugal is emerging as a compelling test case, leveraging its unique advantages in renewable energy, transatlantic connectivity, and natural cooling to attract major investments. But can it translate potential into sustainable, grid-led growth?

In this analysis, Synertics explores Portugal’s new regulatory framework for managing grid capacity and how its strategic approach is positioning the country as a mature, sustainable hub in Europe’s data centre market.

Data centres worldwide are experiencing rapidly increasing electricity consumption, driven by the digital transformation and the expansion of artificial intelligence (AI). The International Energy Agency (IEA) reports that data centre electricity consumption has grown by around 12% per year since 2017, more than four times faster than the rate of total electricity consumption. IEA projections indicate that this demand is set to double to around 975 TWh by 2030 and reach 1 200 TWh by 2035.

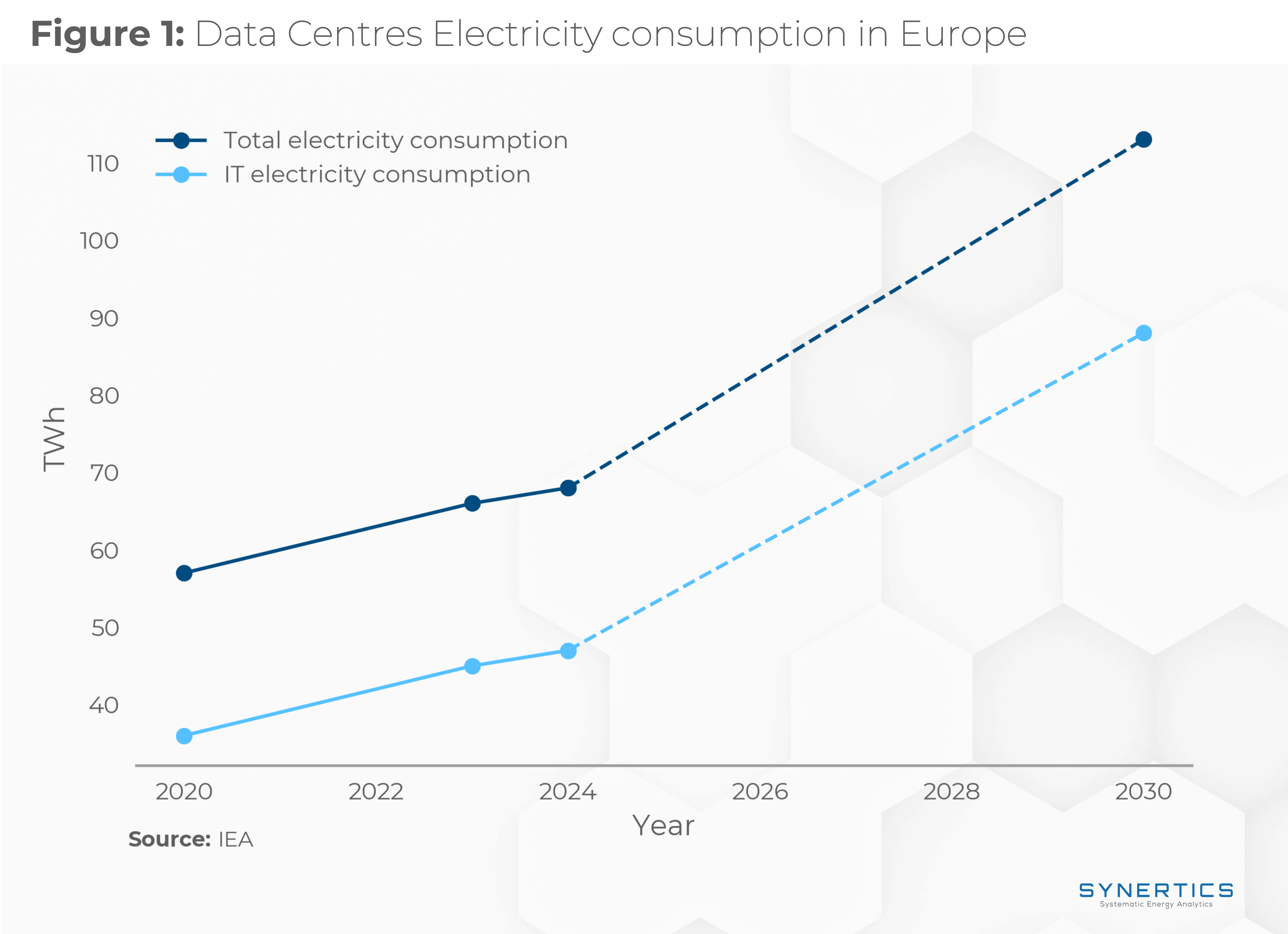

In Europe, this accelerating trend is equally noticeable. In 2024, the continent accounted for 15% of global data centre electricity consumption. This corresponds to approximately 70 TWh, just under 2% of Europe’s total electricity consumption for the year. Figure 1 illustrates the historical electricity consumption of European data centres from 2020 to 2024, alongside IEA projections extending to 2030. The chart shows both total data and IT-specific consumption, with IT equipment accounting for most of the electricity use.

However, this growth faces a critical constraint: grid connections. The IEA estimates that around 20% of planned data centre projects may experience delays due to inadequate grid capacity. Grid connection queues are long and complex, with transmission lines construction requiring 4-8 years and wait times for critical components having doubled in the past three years.

For operators seeking to mitigate these risks, location strategy must now extend beyond traditional factors. Successful siting now requires simultaneous access to four critical infrastructures: grid capacity for uninterrupted power supply, optical fibre networks for low-latency connectivity, industrial land for suitable licensing procedures and water resources for efficient cooling systems.

These infrastructure requirements provide a framework to analyse Portugal's emerging data centre landscape. The country's recent project pipeline serves as a test case for how a country can leverage unique advantages to attract investment, provided it can deliver the underlying infrastructure.

Portugal's appeal as a data centre location rests on three key resources:

Strategic Atlantic Connectivity: Portugal’s location makes it a critical interconnection hub for modern submarine cables, including EllaLink to Brazil and Equiano to Africa. Upcoming projects like Medusa and Nuvem will further enhance links to the Mediterranean and the U.S., providing data centres with essential low-latency connectivity to growth markets and inherent network redundancy.

Rapidly Decarbonising Electricity Grid: Renewable sources (hydro, wind, solar) supplied 71% of national electricity in 2024 . This offers operators a clear pathway to meet sustainability targets.

Efficient Natural Cooling Advantages: The extensive coastline enables efficient seawater cooling systems, while the temperate climate allows for widespread use of energy-saving free-air cooling, significantly reducing operational costs and environmental impact.

Portugal’s foundational advantages in international connectivity, green power and natural cooling create a compelling strategic case. However, for this case to translate into actual project viability, developers must secure three fundamental operational inputs: a grid connection, industrial land and fibre access. Recognising this critical bottleneck and the need to manage allocation transparently in high-demand areas, Portuguese authorities have taken decisive regulatory action. In February 2026, the Directorate-General for Energy and Geology published Announcement No. 16-A/2026 in Portugal's official government journal, the Diário da República. The notice opens a public consultation for an exceptional procedure to allocate connection capacity to the Public Service Electricity Grid (RESP) in officially designated "High-Demand Zones". This framework establishes a formal, competitive process for stakeholders (including data centre developers) to secure long-term capacity, contingent on providing detailed technical plans and substantial financial guarantees. This move is a direct response to global grid constraints and positions Portugal as a market with a managed, transparent approach to infrastructure planning.

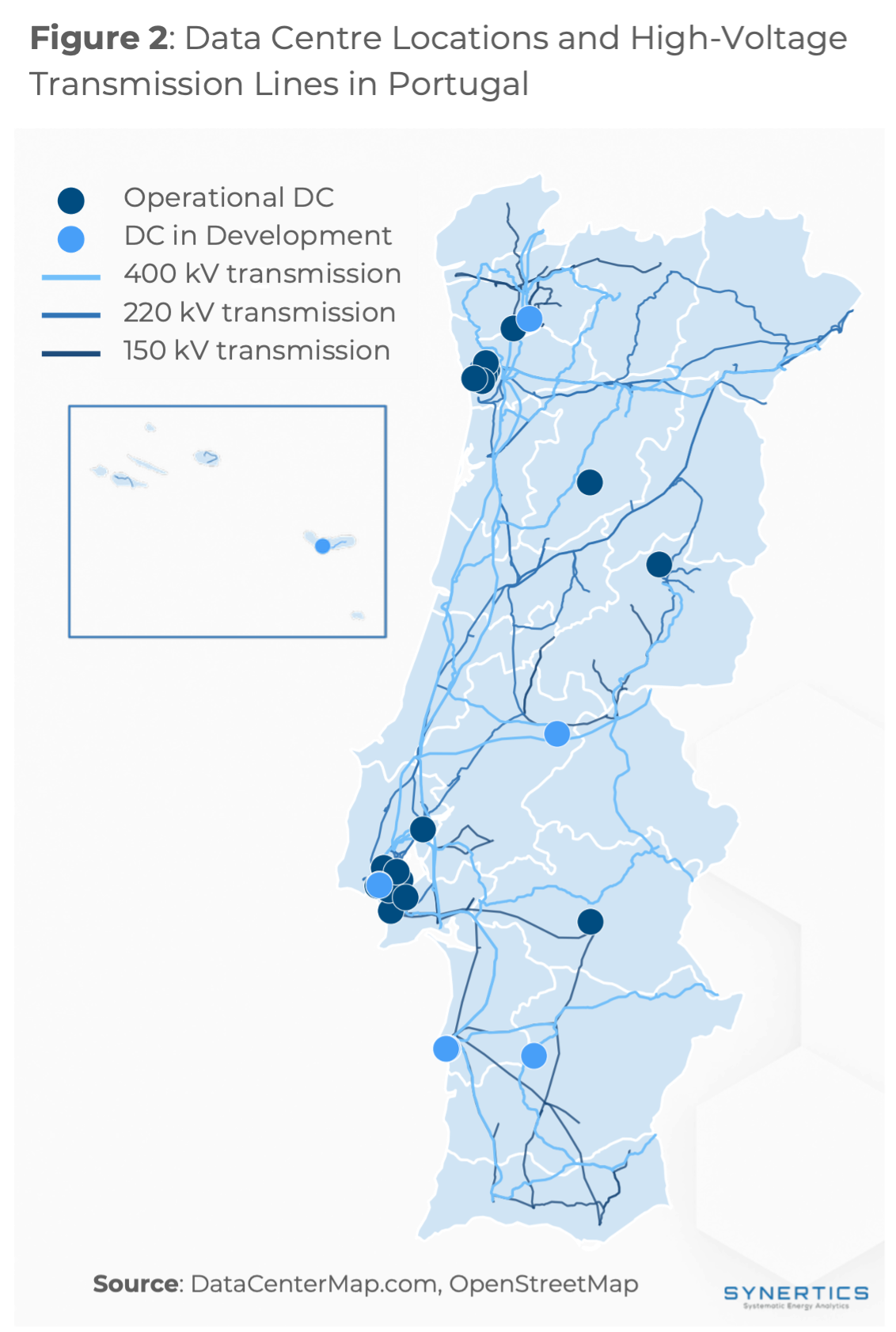

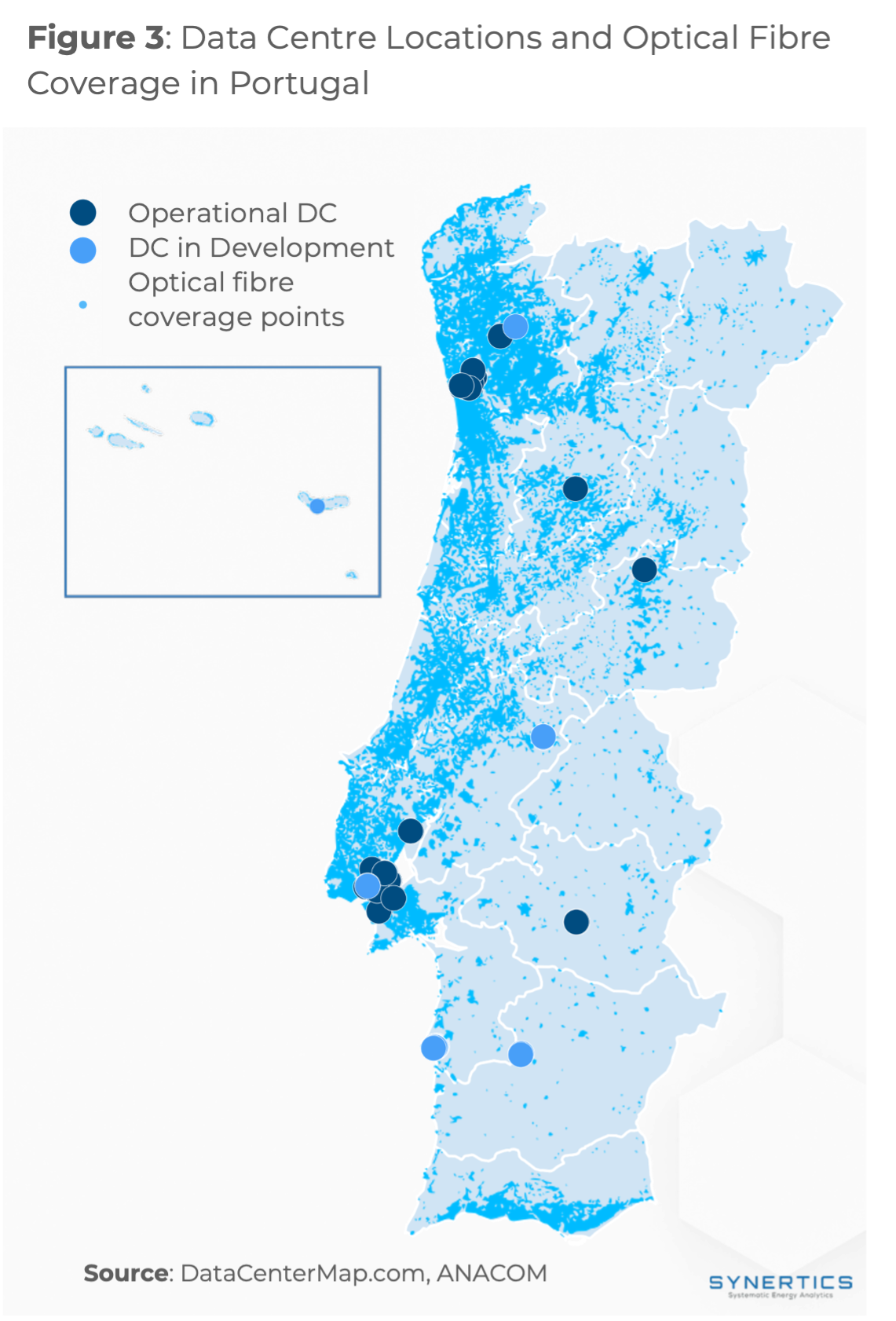

This new framework will shape future development. To understand the baseline it addresses, one can examine the current distribution of projects, which reveals how developers have already been aligning with existing grid and fibre networks (Figures 2 & 3).

First, examining data centre locations relative to Portugal's high-voltage transmission network (Figure 2), a clear pattern emerges: every data centre, including those in more remote inland locations, is strategically positioned near existing power infrastructure. This demonstrates that developers are intentionally leveraging proximity to existing grid capacity to mitigate connection risks and accelerate project timelines. The map also reveals significant untapped potential, with extensive transmission corridors showing strong power line coverage but no current data centre development, highlighting opportunities for future expansion.

Similarly, analysis against Portugal's optical fibre network (Figure 3) shows a deliberate alignment with connectivity hubs. While regional disparities in fibre coverage exist, with urban areas nearing universal access and some interior regions still developing, Portugal is advancing rapidly toward near-national coverage. Significant investments and regulatory efforts are actively improving connectivity across the country. Moreover, even in areas where the map appears sparse, high-speed fibre access is often still feasible, meaning developers are not strictly limited to traditional hubs. This expanding backbone supports a more geographically diversified data centre strategy in the years ahead.

This geographic analysis frames Portugal's current market. Together, the maps identify 36 operational data centres alongside 10 projects in construction or planning phases. Investments concentrate primarily in the Lisbon and Porto metropolitan regions, aligning with existing population and infrastructure hubs.

The maps also reveal strategically positioned projects outside the main urban centres. The SINES Data Campus stands out as the country’s largest and most ambitious hyperscale development, expected to be fully operational by 2030. With a planned total IT capacity of 1.2 GW and an investment of €8.5 billion, it is positioned to become Europe’s largest and most sustainable data centre campus, operating on 100% renewable energy and utilising seawater cooling to minimise its environmental impact.

Another key project is Google’s Cable Landing Station (CLS) in Lagoa on São Miguel Island in the Azores. This 10 MW and 15,000 m2 submarine cable landing facility is expected to be commissioned by early 2027 and will house Google’s next generation transatlantic cables Nuvem and Sol, which will connect mainland Portugal and Spain, respectively, to the United States. This investment cements the Azores archipelago as a critical mid-Atlantic digital corridor.

The evidence confirms Portugal is passing its 'test case.' The geographic clustering of projects near essential infrastructure validates the market's translation of Portugal’s green energy, transatlantic connectivity and efficient cooling into tangible assets. This clustering is precisely the type of concentrated demand that necessitates the kind of proactive governance seen in the recent public consultation (Announcement No. 16-A/2026) to allocate grid capacity, a move that transitions Portugal from a promising location to a strategically managed market.

In conclusion, Portugal demonstrates that a Southern European nation can successfully compete for data centre investment by offering a unique convergence of foundational advantages and forward-looking infrastructure policy. The alignment of projects with physical and regulatory frameworks shows that developers are not just attracted to Portugal's resources, but are actively betting on its capacity for sustainable, managed growth. This positions Portugal not merely as an alternative location, but as a strategically mature and sustainable node in Europe's expanding data centre market.

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025

Market-trends

21st Oct, 2025