Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Guarantees of Origin (GOs) serve as the definitive proof for renewable energy claims in Europe. As the standard Environmental Attribute Certificate (EAC), they create a mutual benefit within the energy market for both renewable energy consumers and producers. For consumers, GOs provide the certified evidence needed to integrate renewables into their sustainability strategy and decarbonize their carbon footprint. Simultaneously, they offer producers a vital source of extra revenue, as these certificates are traded uncoupled from the physical electricity. Recognized by the Greenhouse Gas Protocol for their precision in tracking Scope 2 emissions, GOs function as a cross-border instrument across the EU.

In this post, Synertics discusses how the GOs market is expected to behave in relation with the key factors influencing the GO price market and how Power Purchase Agreements (PPAs) can serve as an effective tool to protect the involved parties from exposure to these key factors.

As EU policy continues to push companies toward cleaner business models, regulatory pressure is reshaping both the quality and the role of Guarantees of Origin. Measures such as RED II/III, rising national renewable-energy targets and the EU Green Deal are driving greater standardisation.

In addition, the proposed revisions to the GHG Protocol Scope 2 Guidance introduce a new layer of pressure on companies to secure higher-quality renewable-energy certificates and avoid greenwashing. Key changes include:

Together, these regulatory developments significantly increase pressure on companies (energy consumers) to secure higher-quality, locationally relevant and time-aligned GOs or other EACs. As a result, demand is expected to shift from low-cost annual certificates toward more credible, granular and system-aligned instruments, accelerating differentiation within the GO market.

Understanding the validity of GOs is essential, as it influences how different market participants operate. Once a GO is issued to a producer, its price may fluctuate based on the value perceived by energy consumers. Usually, a GO is valid for 12 months after the end of the production period, although in some countries this validity can extend to 18 months, after this duration period the GO expires.

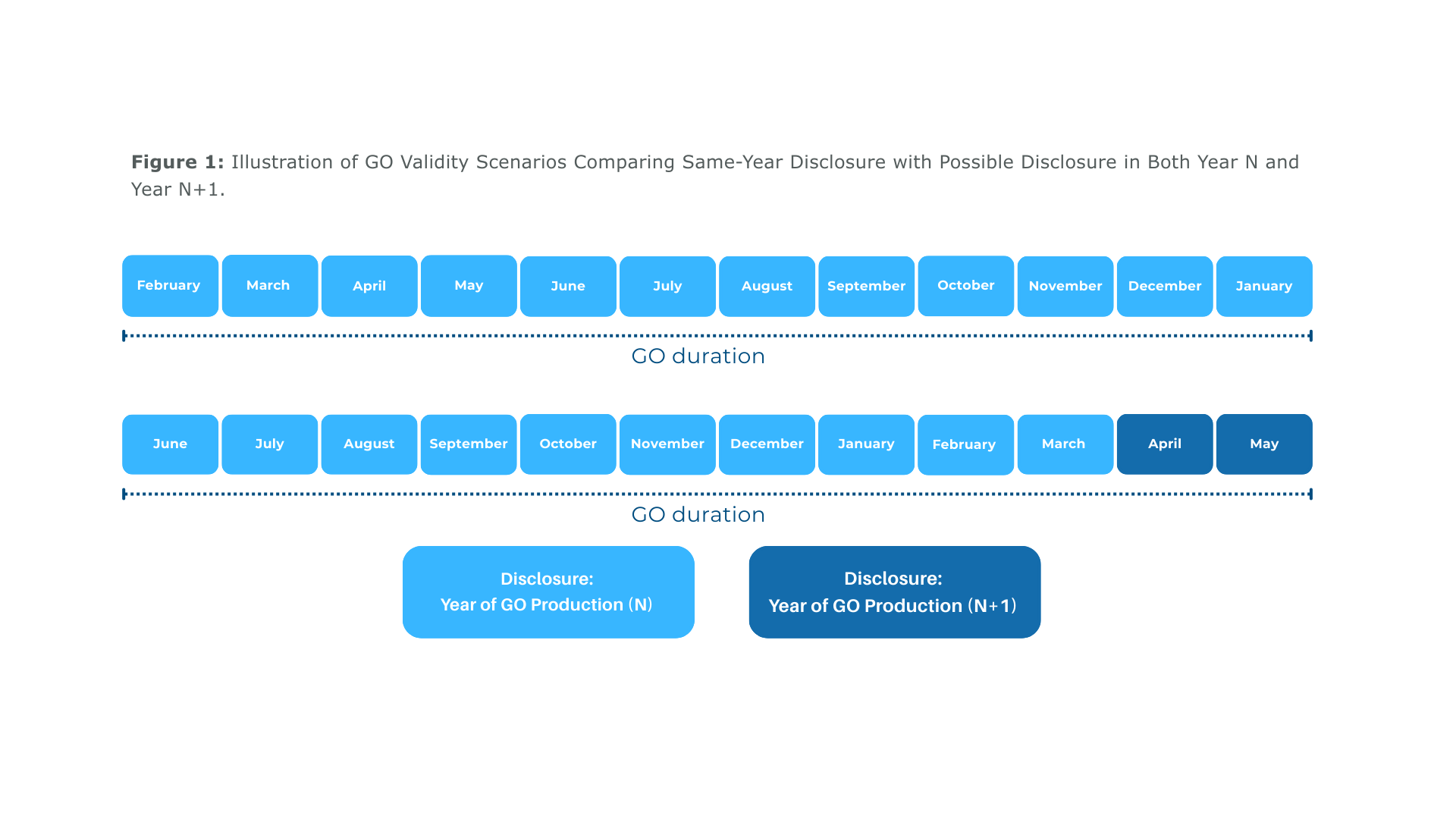

During this period, GOs must be cancelled (redeemed) by the buyer to prove the renewable claim. The timing of the cancellation plays a key role in determining which reporting period a GO can support. Many European countries follow an annual disclosure cycle in which electricity consumption for year N can be supported by cancelling GOs for that year until the end of the first quarter of year N+1. If a GO is not cancelled by this disclosure deadline, while still within its validity period, the certificate can no longer be used for year N and may only be applied to the following reporting year (N+1), as illustrated in Figure 1 .

Although disclosure timelines are not fully harmonised across Europe, most countries follow similar principles that place the deadline in the first quarter of the following year. The main drivers for this timing include the need for companies to consolidate metering and consumption data after year-end, the requirement for regulators to carry out audit and verification processes before publication deadlines and the practical benefits of synchronisation across Europe, which facilitates smoother cross-border trading and harmonised disclosure practices.

These protocols, which countries adopt based on the specifications of the EECS rules and the annual reporting deadlines for electricity consumption, can create a strong seasonal peak from December to March. During this period, companies rush to cancel GOs in time to meet their Scope 2 requirements under the GHG Protocol and to advance toward renewable procurement commitments such as RE100.

Supply and demand plays a major role in GO prices, where producers have significant influence. When renewable generation is low, demand quickly pushes prices up; when production is high, prices fall.

As seen in AIB reports, hydropower is generally the main source of GO supply in many European countries. Its certificates usually enter the market from March to May as reservoirs are fulled after winter, supporting overall market stability. However, lower rainfall can reduce hydropower production, severely limiting supply and raising prices.

Consequently, hydro-rich countries tend to dominate exports. In 2024, countries with highly developed hydro capacity, such as Norway, Sweden and France, were the largest GO exporters. Conversely, nations with high demand and strict regulatory needs, including Germany, the Netherlands, Ireland and Switzerland, heavily relied on imports. Seasonality from other renewables reinforces these patterns. Strong solar production during summer increases GO availability and typically brings prices down, whereas low overall renewable output in winter creates tighter market conditions, often resulting in short periods of elevated demand and price spikes.

In overall, the supply and demand dynamics are a key factor to the GOs prices since they bring a seasonal pattern to the GOs market.

With the existing timeframe for using Guarantees of Origin, companies aiming to meet annual sustainability targets, combined with seasonal patterns, shifting supply–demand dynamics and stronger regulatory pressure, may face uncertainty in GO prices. Following a major price correction in 2024/2025 after sustained growth until 2023, where prices reached around 7 to 10 €/MWh, continued high volatility is expected. Prices will be increasingly driven by the tension between tightening regulations (boosting demand) and the rising supply from new renewable capacity across Europe, all amplified by unpredictable external factors like weather and policy changes. To this, producers must stay attentive to these changes to make the best use of their certificates.

A reliable way to reduce this uncertainty is through PPAs. Since GOs are often included in these contracts, PPAs help lock in both energy and certificate value, creating stable demand. This opens opportunities for producers to secure long-term deals, whether pay-as-produce or hybrid PPAs, as companies increasingly seek protection from market swings.

With Synetics and our PPA tool, we can help you quickly identify and close the right PPA to secure stronger and more predictable GO pricing.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026