Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

Let's explore how this PPA pricing structure works and how it can be beneficial for both offtakers and generators.

In the world of renewable energies, Power Purchase Agreements (PPAs) are essential for ensuring a steady revenue stream for producers and a stable supply at a fixed price for consumers.

The complexity of PPAs can vary significantly, with different pricing structures tailored to the risk and return needs of both parties. One such structure includes the deferred settlements mechanism, which offers a flexible and balanced way to manage market fluctuations.

Power Purchase Agreements, serve as formal agreements between an energy generator (often focusing on renewable sources) and an offtaker (such as a corporation aiming to minimise its environmental impact). These agreements specify the quantity of energy provided, pricing terms, contract duration, and other pertinent conditions.

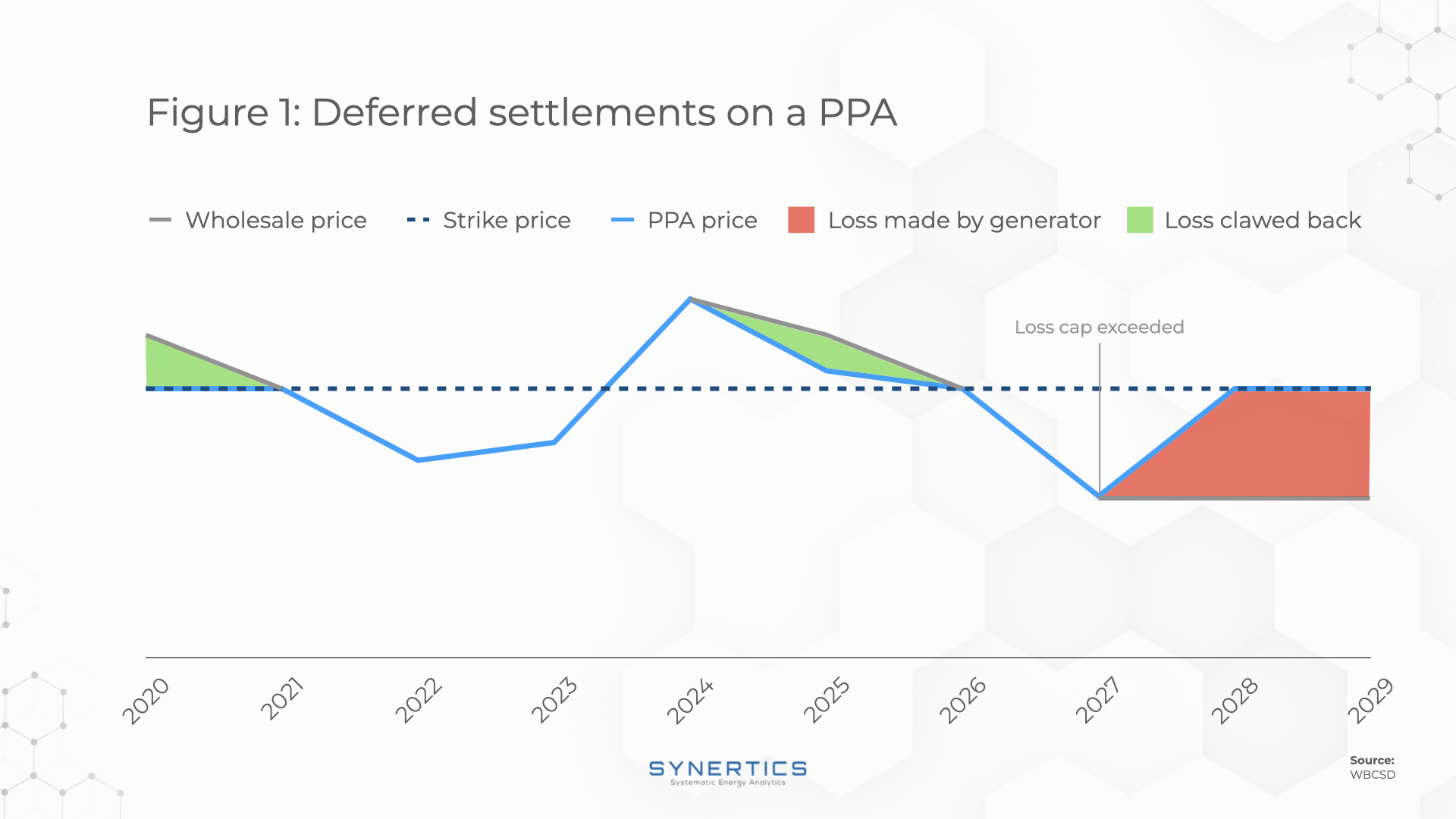

One notable feature of some PPAs is the deferred settlements mechanism. This feature allows for adjustments in payments when there are significant shifts in market prices or deviations in the expected levels of energy production.

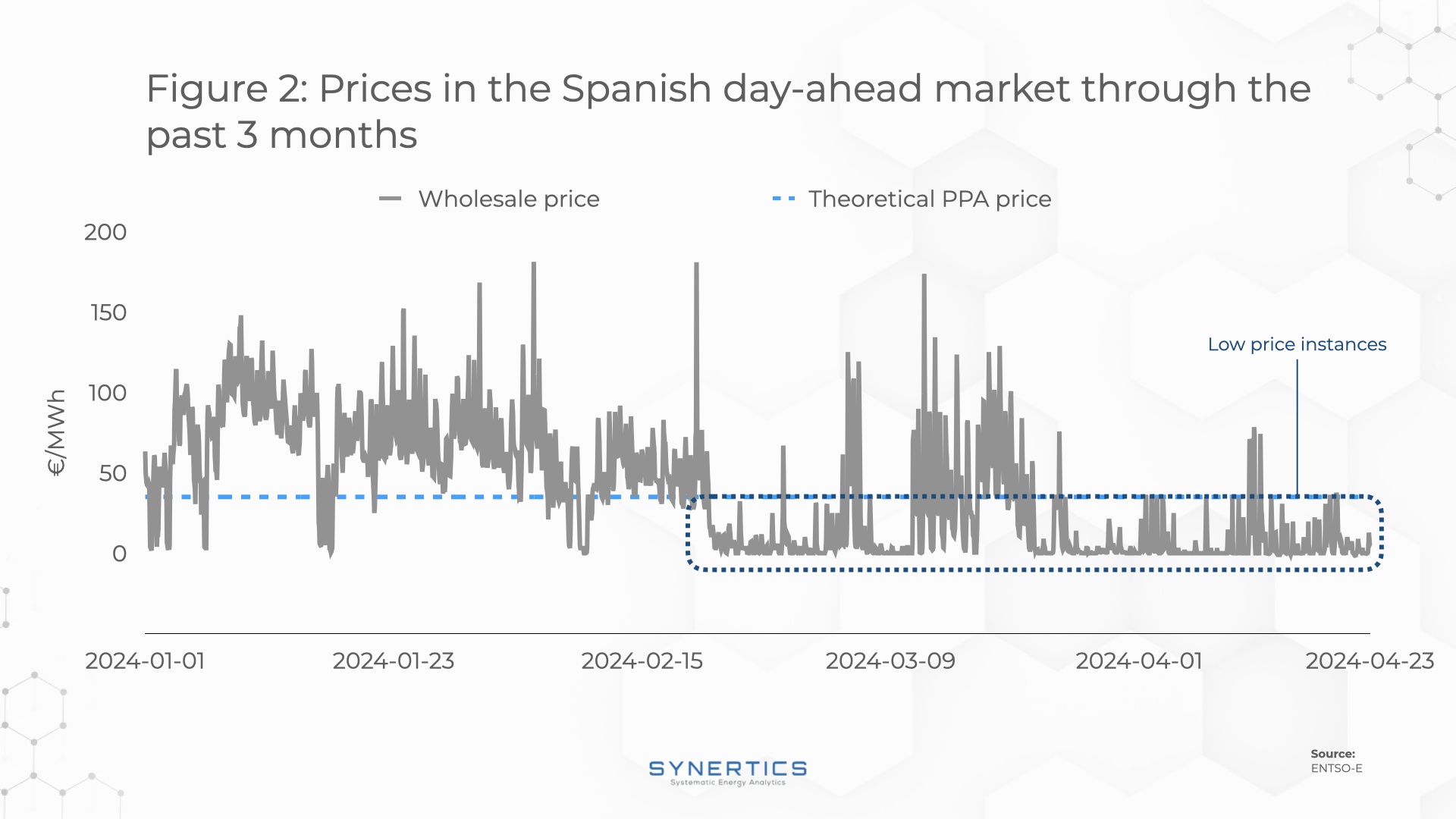

For example, in the Iberian market, the growing influx of renewable energy has led to notably low prices. While this may appear beneficial from a consumer's perspective, it can render operations financially unsustainable for generators.

The graph below illustrates trends in day-ahead energy prices over the current year:

When a producer is confronted with consistently low or even negative prices, it can be difficult to secure an energy contract that is economically viable for the next 5 to 10 years.

One possible solution is to include the deferred settlements mechanism in the contract. This allows for payment adjustments in case market conditions fluctuate significantly, ensuring the financial sustainability of the contract for its entire duration.

In the compensation example for downward and upward price movements, the mechanism works like this:

If the market price increases, the energy generator (seller) can "compensate" an amount that was previously granted to the buyer when the price was lower. This is done by adjusting the price the buyer pays upwards until the seller has recovered the amount equivalent to the benefit the buyer received from the previous price drop.

This recovery continues until the amount lost by the seller is completely compensated, respecting an established loss cap. After reaching this limit, the price returns to the initial value of the PPA, protecting the seller from greater losses.

The use of the compensation mechanism in PPAs offers several advantages:

Flexibility

In a scenario of high incidence of lower prices, this structure makes it viable to negotiate with corporates. Both parties can negotiate terms that best suit their operational and financial needs, adapting the contract to market conditions and sustainability objectives.

Compensating for low prices

Helps energy producers manage the risk of drastic fluctuations in energy prices to manage your exposure to low market prices without making your business unviable. This loss cap acts as a safety net and ensures that if losses exceed a predetermined limit, the price of energy will be returned to the previously agreed PPA price. In some cases, an extension period of compensation may be added to allow the seller to recoup losses that exceed the loss cap.

Price structures in PPAs, especially those that include compensation mechanisms, are powerful tools for aligning the interests of energy generators and offtakers.

In situations where there are many producers and low market prices, it becomes necessary to find mechanisms that can make PPAs contract prices more competitive and viable for renewable energy projects. PPAs with deferred settlements can be a constructive mechanism, where energy generators exchange better offtaker liquidity terms for higher PPA prices.

This structure would be most effective during times when the market prices are expected to be low in the short or medium term, or when there is high volatility, allowing producers to offset these prices.

Moreover, the compensation mechanism could be particularly useful for corporate buyers, such as electro-intensive companies, who wish to reduce their exposure to energy price volatility while still being able to take advantage of short-term opportunities on lower prices.

Insights

22nd Jan, 2026

Insights

12th Jan, 2026

Insights

12th Jan, 2026