Join us on our journey towards renewable energy excellence, where knowledge meets innovation.

In our previous article, we explored the concept of energy imbalances, the key factors driving imbalance costs, and what generators should consider when negotiating market representation contracts.

In this article, we shift focus to the Nordic balancing market, with a particular emphasis on Sweden and Finland. We’ll examine how these markets operate, explore the underlying reasons behind recent price surges, and present a fee estimation analysis developed by Synertics.

In the Nordincs, the imbalance settlement is managed by eSett, a joint company owned by the 4 TSOs Transmission System Operators (TSOs): Energinet, Fingrid, Svenska kraftnät, and Statnett. This institution guarantees a harmonised framework across the member countries to ensure a unified and efficient approach to electricity market operations. eSett is responsible for calculating and settling imbalances for each Balance Responsible Party (BRP), based on their scheduled trades and actual consumption or production. Additionally, eSett manages the financial settlements between TSOs and Balancing Service Providers (BSPs) for balancing services, ensuring that any differences between activated and delivered reserves are accounted for.

The model has followed the same operation for Sweden and Finland since 2021, under a single imbalance price system, simplifying the settlement process and promoting real-time balance maintenance. This single imbalance price is calculated by adding system costs to match the supply and demand by the TSO to the day-ahead price.

Sweden transitioned from 1-hour settlements to 15-minute periods in 2025, almost 2 years after Finland transitioned.

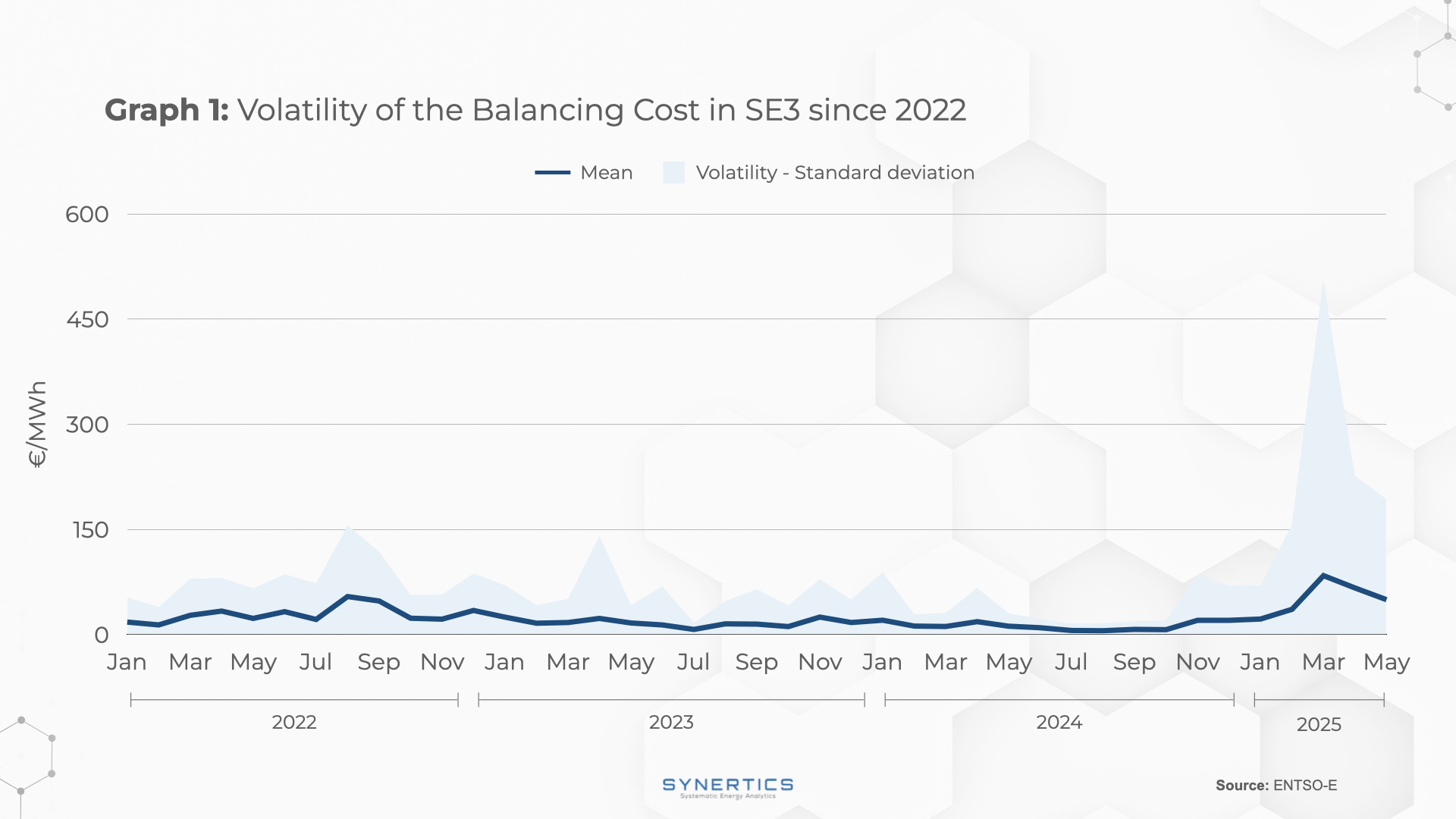

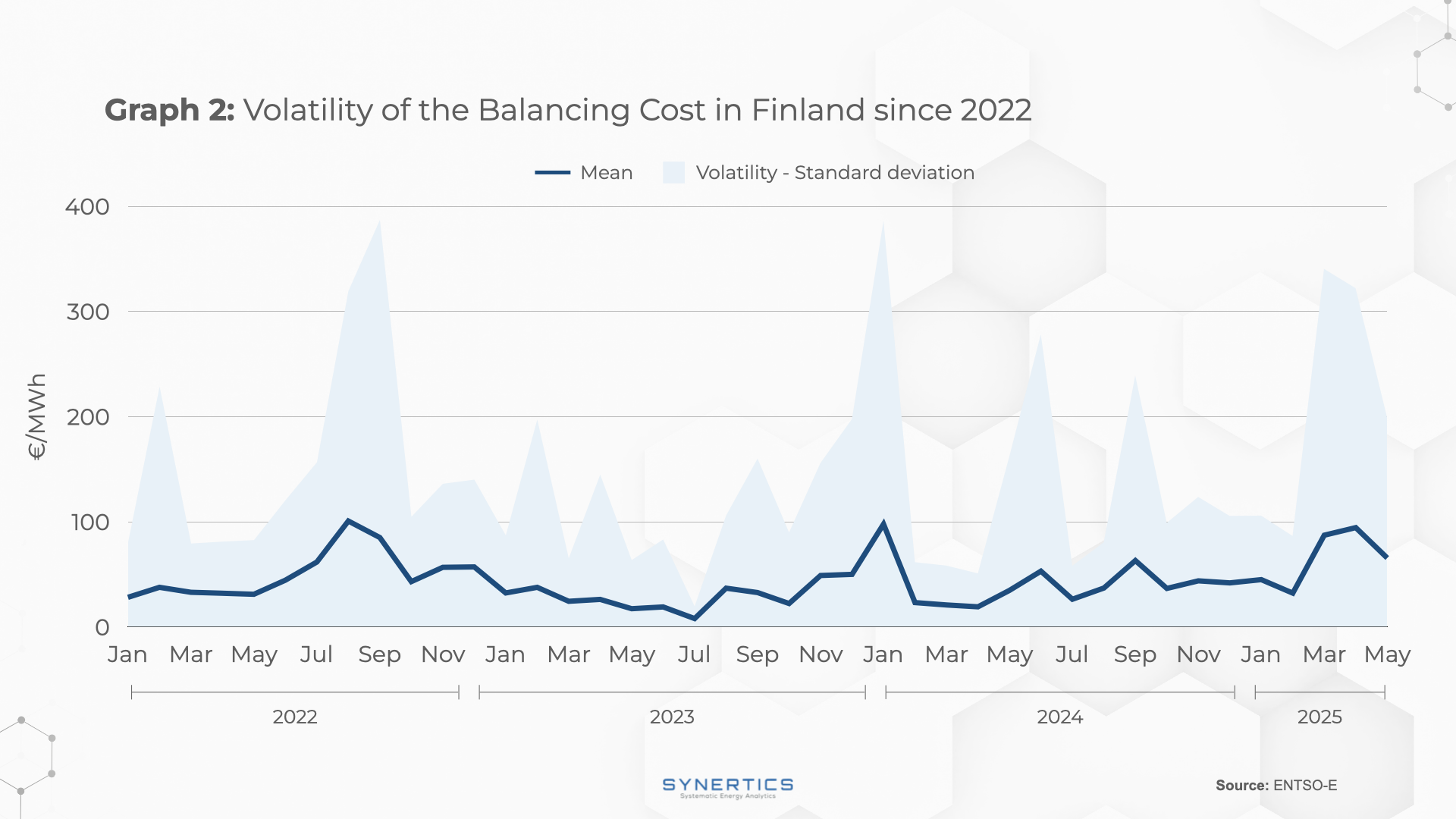

In recent months, the Nordic region has undergone fundamental shifts in imbalance price trends. Figure 1 shows the monthly evolution of average imbalance prices and their volatility in Sweden's SE3 zone since 2022, while Figure 2 presents the same data for Finland. Historically, Finland has exhibited greater volatility, whereas Sweden has maintained a more stable profile. However, the most recent quarter marks a departure from this trend, with Sweden recording the highest volatility ever observed. In extreme cases, imbalance prices exceeded €10,000/MWh.

This sharp rise in volatility and price levels can be largely attributed to Sweden’s recent transition to 15-minute settlement periods. While the new structure enables more accurate real-time matching of supply and demand, many BRPs are still adjusting their operations and forecasting models. This learning curve has increased the likelihood of short-term imbalances, contributing to the observed volatility.

Additionally, a major structural change in the Nordic balancing market has compounded the issue: the recent automation of mFRR (manual Frequency Restoration Reserve) activation. The updated balancing algorithm now optimises mFRR activations strictly based on system conditions, without factoring in potential price spikes or volatility, an area where human operators previously exercised discretion. As a result, market participants widely attribute these algorithm-driven decisions as a primary cause of the extreme price surges.

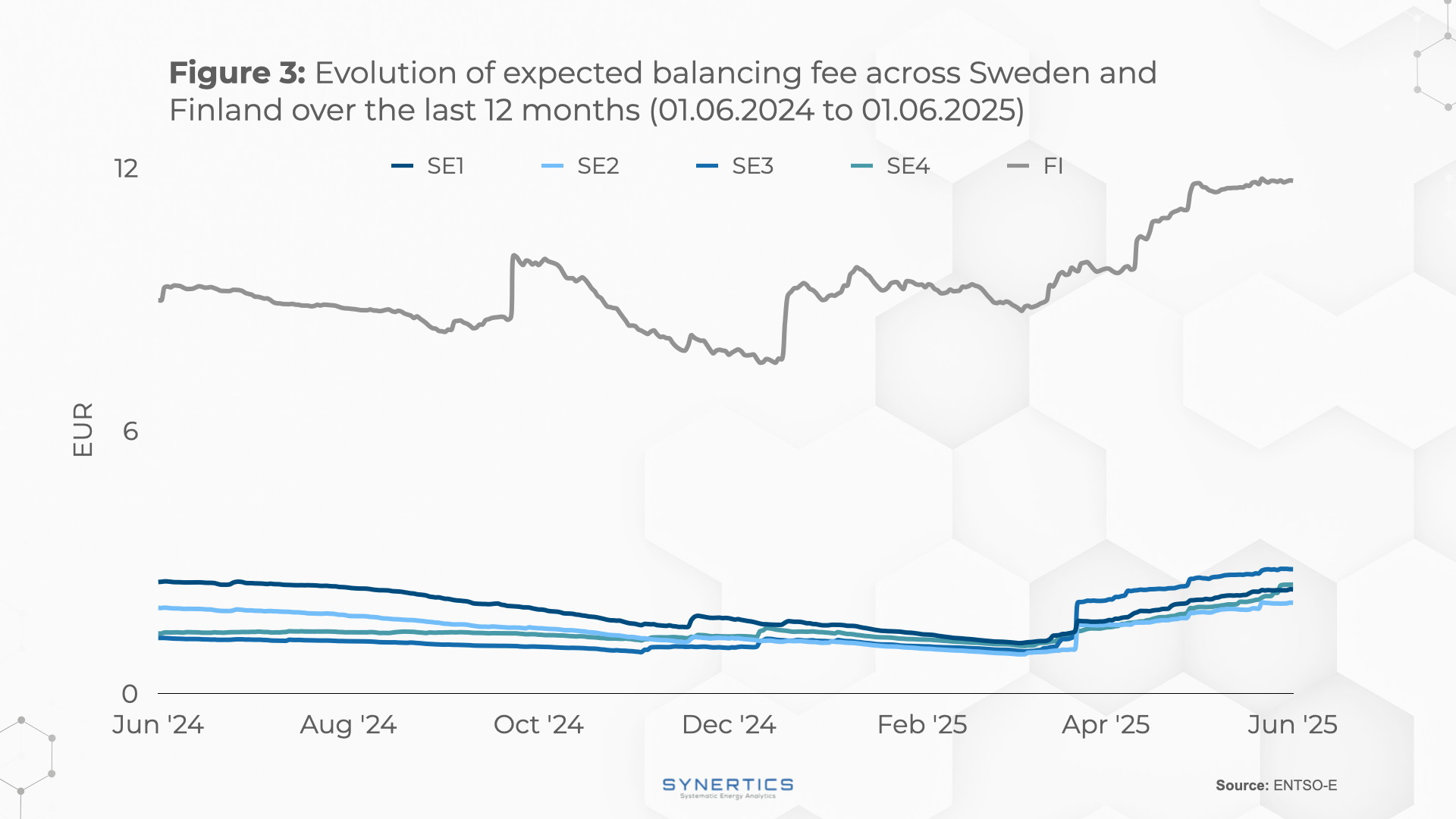

Figure 3 illustrates the estimated evolution of balancing fees over the past 12 months. At each quotation date, the estimation considers historical imbalance volumes and prices from the preceding year.

The figure highlights the alignment across Swedish bidding zones, all of which show a sharp increase in estimated fees during the first quarter of this year. This spike correlates with the structural and regulatory changes discussed in the previous section.

In Finland, the variability remains more pronounced, largely driven by the typical volatility observed in the country’s imbalance costs. Despite these differences, both Sweden and Finland are exhibiting a clear upward trend in expected balancing costs, signalling a growing financial impact for market participants across the Nordic region.

The Nordic balancing market is undergoing a period of significant transformation, driven by regulatory shifts, and evolving market structures. The introduction of 15-minute settlement periods in Sweden and the automation of mFRR activations mark important steps toward greater system efficiency, but they have also introduced new challenges, particularly around price volatility and predictability.

Recent data shows a clear upward trend in imbalance costs across both Sweden and Finland, with extreme price spikes raising the stakes for generators and market participants. As BRPs adapt to the new market design, short-term inefficiencies are likely to persist.

For generators operating in the Nordics, closely monitoring regulatory developments and understanding their financial implications is essential and implementing strategic risk management will be key to navigating the rising cost of imbalances.

Stay informed on balancing costs with the Synertics PPA Evaluation Tool. Register for a free demo or schedule a call to learn more on how to de-risk your project.

Insights, Market-trends

15th Dec, 2025

Market-trends, Projects

27th Nov, 2025

Market-trends

21st Oct, 2025